Renting vs Buying a House in Reno: A Comparison

Deciding whether to rent or buy a house in Reno is a significant choice that can impact your financial and lifestyle futures. This article provides a detailed comparison of both options, helping you make an informed decision tailored to your personal circumstances.

Understanding the Basics: Renting and Buying Renting a house means paying a landlord a periodic fee, typically monthly, for the right to live in the property. In contrast, buying a house involves obtaining financing, usually via a mortgage, to purchase the property outright, making you the owner.

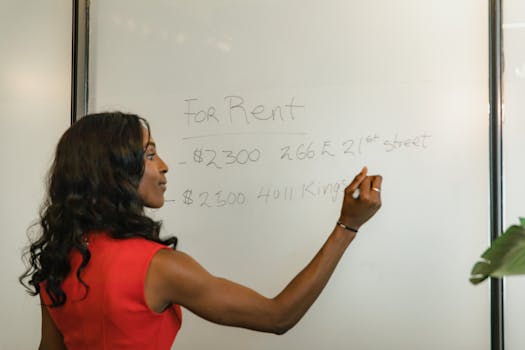

Advantages of Renting in Reno Flexibility is a major advantage of renting. Renters can move at the end of each lease period, which is perfect for those who are not ready to settle in one place or whose job requires frequent relocations. Renting also means fewer maintenance responsibilities; most repairs and upkeep are the landlord's responsibility. Additionally, renting requires less upfront cash than buying, as there are no down payments or closing costs, just a security deposit and the first month's rent.

Disadvantages of Renting The primary downside of renting is the lack of equity building. Rent payments go to the landlord and do not contribute to any asset ownership. Furthermore, renters have limited control over their living space and might face restrictions on pets, renovations, and even long-term guests. Rent can also increase over time, subject to the terms of the lease and market conditions.

Advantages of Buying a House in Reno Buying a house in Reno allows you to build equity over time, especially as property values increase. Homeownership also offers stability; you can stay in your home as long as you wish, without fear of lease termination. Additionally, owning a home gives you full control over the property, enabling you to customize your living environment according to your tastes and needs. The potential for rental income, should you choose to rent out part or all of the property, is another benefit.

Disadvantages of Buying The initial costs of buying a home are substantial. Aside from the down payment, there are closing costs, home inspections, and moving expenses. Owning a home also comes with ongoing costs like property taxes, homeowners insurance, and maintenance. The financial responsibility can be significant, particularly if unexpected repairs arise.

Practical Examples Consider a family deciding between renting a three-bedroom home or buying a similar property in Reno. Renting might cost them $1,500 per month without the burden of maintenance, whereas buying might involve a $300,000 price tag with a $60,000 down payment and additional monthly costs for mortgage payments, taxes, and maintenance.

Conclusion: Which is Better for You? The decision to rent or buy in Reno depends on your financial situation, lifestyle needs, and long-term goals. If you value flexibility and minimal responsibility, renting could be the better choice. However, if you are looking for stability, control, and the financial benefits of equity, buying might be the right option.

Before making a decision, consider speaking with real estate and financial professionals to get advice tailored to your specific situation.

.png)